Little Known Questions About Hard Money Georgia.

Wiki Article

Our Hard Money Georgia Diaries

Table of ContentsMore About Hard Money GeorgiaThe Facts About Hard Money Georgia RevealedGetting The Hard Money Georgia To WorkFacts About Hard Money Georgia Revealed

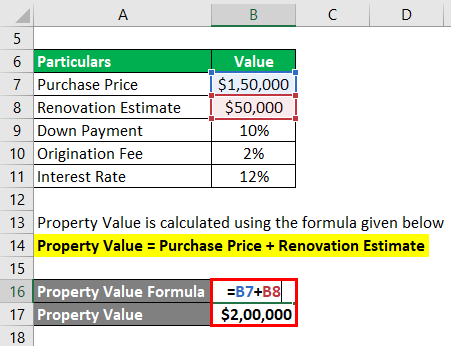

Because hard cash financings are collateral based, additionally referred to as asset-based fundings, they require minimal documents as well as allow capitalists to shut in a matter of days. Nonetheless, these finances included more threat to the loan provider, and consequently need greater deposits and have greater rate of interest than a typical funding.In enhancement to the above break down, tough money finances and typical mortgages have various other distinctions that distinguish them psychological of financiers and loan providers alike: Hard cash car loans are funded faster. Lots of standard loans might take one to 2 months to shut, but tough money lendings can be shut in a couple of days.

A lot of tough cash finances have short payment periods, normally in between 1-3 years. Conventional home loans, on the other hand, have 15 or 30-year settlement terms typically. Hard money car loans have high-interest prices. The majority of tough money financing rate of interest are anywhere between 9% to 15%, which is substantially more than the rate of interest you can anticipate for a traditional mortgage.

This will certainly consist of buying an evaluation. You'll receive a term sheet that outlines the loan terms you have actually been authorized for. When the term sheet is signed, the loan will certainly be sent to processing. Throughout finance processing, the lender will certainly request documents and also prepare the finance for final lending testimonial as well as schedule the closing (hard money georgia).

The Best Strategy To Use For Hard Money Georgia

In essence, since people or corporations provide tough money fundings, they aren't based on the same guidelines or constraints as financial institutions and cooperative credit union. This suggests you can obtain unique, personally tailored difficult cash loans for your particular requirements. That claimed, tough cash lendings have some drawbacks to remember prior to seeking them out.You'll require some resources upfront to certify for a tough cash lending and the physical residential property to work as security. This can make tough cash financings inaccessible for some investors or residential or commercial property owners. Furthermore, hard cash loans usually have higher passion prices than typical home mortgages. They are additionally interest-only financings which suggests your month-to-month repayment only covers interest and the major quantity will be due at maturation as a lump sum.

Common leave techniques consist of: Refinancing Sale of the possession Payment from other resource There are numerous scenarios where it may be useful to utilize a tough money loan. For beginners, investor that such as to house flip that is, purchase a review residence in requirement of a great deal of work, do the job directly or with specialists to make it better, after that reverse as well as market it for a higher rate than they purchased for might locate hard money lendings to be excellent funding choices.

As a result of this, professional home fins usually like short-term, hectic funding remedies. On top of that, home fins generally try to sell houses within much less than a year of acquiring them. Because of this, they don't need a long term as well as can prevent paying as well much rate of interest. If you buy investment residential or commercial properties, such as rental properties, you might likewise discover difficult cash financings to be excellent selections.

The Ultimate Guide To Hard Money Georgia

In some situations, you can likewise make use of a tough cash funding to purchase vacant land. Keep in mind that, even in the above circumstances, the possible drawbacks of tough cash fundings still use.

Tough money lendings usually come with greater interest prices as well as much shorter payment schedules. Why pick a hard cash funding over a conventional one?

The Basic Principles Of Hard Money Georgia

Additionally, because private individuals or non-institutional lenders offer hard money lendings, they are not subject to the same regulations as conventional lending institutions, that make them extra high-risk for debtors. Whether a difficult money funding is ideal for you depends upon your situation. Hard cash financings are excellent choices if you were rejected a conventional lending and require non-traditional funding.Get in touch with the expert home mortgage experts at Right Begin Mortgage. hard money georgia to find out more. Whether you wish to purchase or re-finance your house, we're here to aid. Start today! Ask for a totally free personalized price quote.

The application procedure will usually involve an analysis of the building's value and also capacity. That way, if you can not afford your settlements, the hard cash lender will merely move in advance with selling the property to recover its investment. Difficult cash loan providers typically charge greater rates of interest than you 'd have on a typical Clicking Here funding, but they likewise money their lendings quicker as well as usually need much less documentation.

Rather than having 15 to three decades to repay the loan, you'll normally have simply one to five years. Difficult money loans work fairly in a different way than conventional financings so it is essential to comprehend their terms and also what purchases they can be used for. Difficult cash financings are generally meant for financial investment properties.

Report this wiki page